National Estate Planning Awareness Week was adopted in 2008 to help the public understand what estate planning is and why it is such a vital component of financial wellness. By preparing an estate plan in October, you’re

According to the most recent statistics, only about only 33% of Americans have established estate plans. The 2022 Wills and Estate Planning Study by Caring.com found that 56% of Americans think having a will is important, but only 1 in 3 Americans actually have an estate planning document. In addition, the study found that:

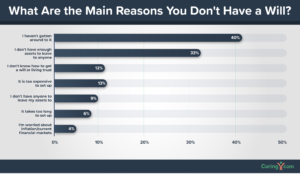

When a celebrity like Chadwick Boseman or Anne Heche dies without a will, it raises public awareness but doesn’t influence people to make a will to protect their loved ones. Caring.com found that the main reasons people don’t have a will are:

40% of Americans say they don’t have a will because they haven’t gotten around to it yet. Don’t be like Chadwick, Anne, or the millions of others who have died without a will and left their families with unneeded stress, worried about money and unnecessary probate costs.

1. Creating An Estate Plan Is Easy – With Guidance

An experienced estate planning attorney can help you make an estate plan that protects you today – and protects your loved ones after you are gone.

2. Creating An Estate Plan Isn’t Expensive

When you create an estate plan, you are making an investment that could save thousands of dollars – or more – after you are gone. Without an estate plan, your family may have limited access to money while the estate is in probate. This means your estate may have to spend thousands of dollars on probate costs that you can avoid with careful estate planning.

3. You’re Never Too Young To Need An Estate Plan

If you’re over 18 and you have “stuff” you need an estate plan. If you own a car, have a savings or crypto account, have a job, or have student loans – you need to let your loved ones know what you want to be done with your things. And if you become ill, who do you want to make your medical decisions and handle your finances?

Celebrate National Estate Planning Awareness Week by Contacting us today at the Estate & Probate Legal Group at 630-864-5835. Our experienced attorneys can advise you on the best options to protect your loved ones.

Areas we serve: Cook, DuPage, Kane, Lake and Will counties.